Leading the way as a global provider in Card-Not-Present 3D Secure processed transactions for card issuers, payments processors, and fintech solution providers.

Protect your cardholders and increase transaction volume, revenue, and user experience with ActiveAccess. Build trust, loyalty, and satisfaction through a secure shopping experience. Discover the power of ActiveAccess, the robust and market-leading Access

Control Server (ACS) platform designed to provide unparalleled cardholder authentication for card issuers. Elevate your business with ActiveAccess now.

Boost sales, build customer trust, and protect your business by minimising risk and offering a secure and effortless shopping experience.

Delivering smooth cross-industry and cross-border coverage with seamless interoperability, enabling global reach and efficient business connectivity.

Utilise various parameters in the ACS to ensure a thorough assessment of transaction risk, improving the security of digital payments.

Gain a competitive edge through unmatched agility, enabling rapid adaptation to changes, by forming a partnership with GPayments unlike any other.

Secure customer transactions and prevent fraud and chargebacks through advanced authentication and real-time fraud detection techniques.

ActiveAccess Service places a strong emphasis on security and compliance to ensure your adherence to payment industry security and compliance regulations.

Stay ahead of the competition by scaling and expanding seamlessly with international and domestic card scheme support.

Experience unrivalled sales and support assistance thanks to a single point of contact, for all enquiries, and proactive resolution of your queries.

Take advantage of the best of both worlds: store cardholder information locally in the ACS or integrate with current card management systems for flexible remote authentication.

Flexible adapter-based interface for issuer risk rules and seamless integration with third-party RBA solutions. Communicate with third-party OOB services for

enhanced authentication options.

Effortlessly manage multiple issuers and independent entities with custom configurations, branding, or cohesive groups to streamline operations.

Deliver seamless biometric authentication within browsers through Secure Payment Confirmation (SPC). Cardholders can approve transactions instantly using fingerprint or facial recognition, combining speed, convenience, and compliance with industry standards.

Unlock real-time visibility across your authentication ecosystem. Dynamic dashboards provide instant insight into transaction volumes, success ratios, and device channels, empowering you to refine strategies, and optimise performance with confidence.

Enhance authentication flexibility with ActiveAccess’ adapter-based API. Seamlessly communicate with third-party authentication services beyond 3Dsecure flow, allowing cardholders offline authentication for up to 7 days.

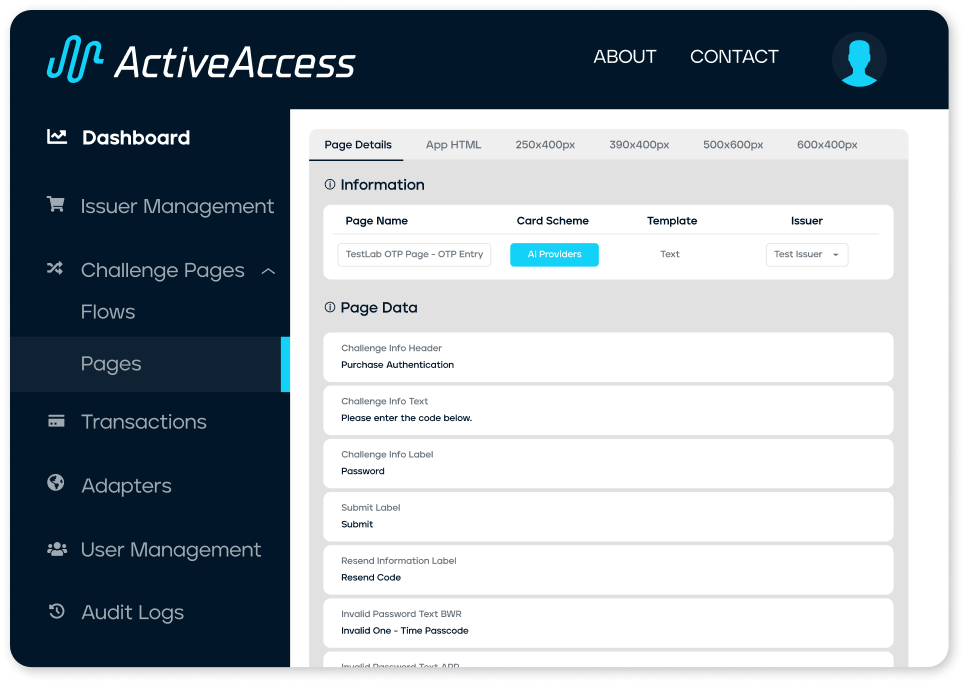

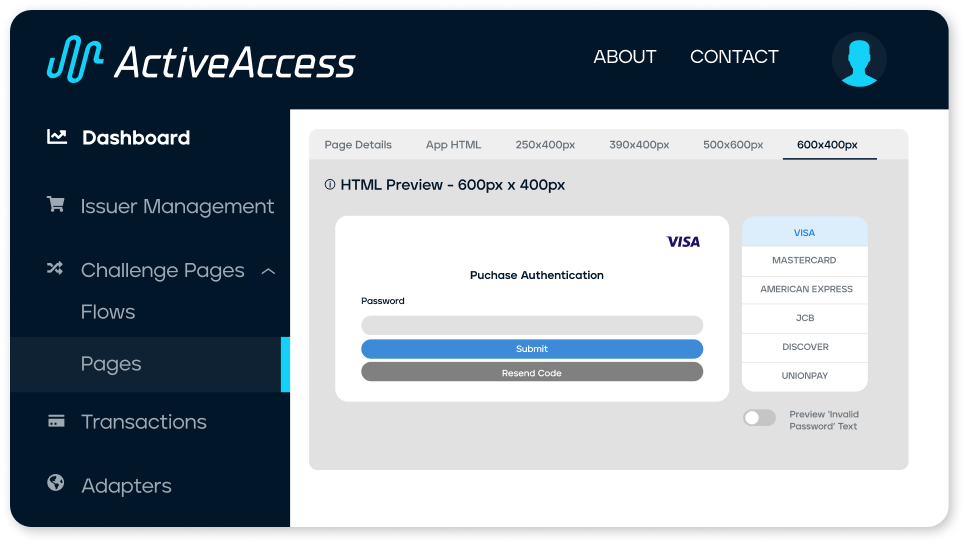

Bring your brand to life with flexible, interactive challenge pages configuration tailored to transaction context and cardholder preferences. Customise visuals and messaging to ensure every interaction feels intuitive, secure, and uniquely yours.

Whitelisting API enables cardholders to create and manage whitelists of trusted merchants, allowing for bypassing authentication, and empowering issuers to manage these lists and view/remove trusted merchants through the administration console.

Experience peace of mind with ActiveAccess, our advanced solution that embraces PSD2's Strong Customer Authentication (SCA) requirements. Safeguard your transactions with unique authentication codes while empowering payers with real-time payment details.

ActiveServer implements a 3DS2 enrolment check API to enable backwards compatibility with your 3DS1 systems. ActiveServer caches the BIN ranges of cards that are enrolled in 3D Secure 2. Before each authentication, the API call can be made to determine whether the given card supports 3D Secure 2. If not, you may fall back to an existing 3D Secure 1 MPI implementation. This API ensures compatibility with any 3D Secure 1 MPI on the market, and is crucial for merchants to obtain liability shift on 3D Secure 1 before liability shift for 3D Secure 2 is activated, or to adhere to regional mandates.

Enterprise-level hosted solution for fraud prevention, with secure multi-tenancy ActiveServer cluster, hosted on a world-leading cloud provider.

Hosted solution with control and customisation options. Clients can delegate service maintenance or self-manage.

Easy installation, on-premise deployment, high-availability cluster configuration, and customisable administration options.

Bank-grade hosted solution for fraud prevention, with secure multi-tenancy ActiveAccess cluster, hosted on a world-leading cloud provider.

Hosted solution with control and customisation options. Clients can delegate service maintenance or self-manage.

Easy installation, on-premise deployment, high-availability cluster configuration, and customisable administration options.

Please feel free to reach out to us if you have any enquiries. Our team is readily available to assist you and will provide prompt responses to your questions.